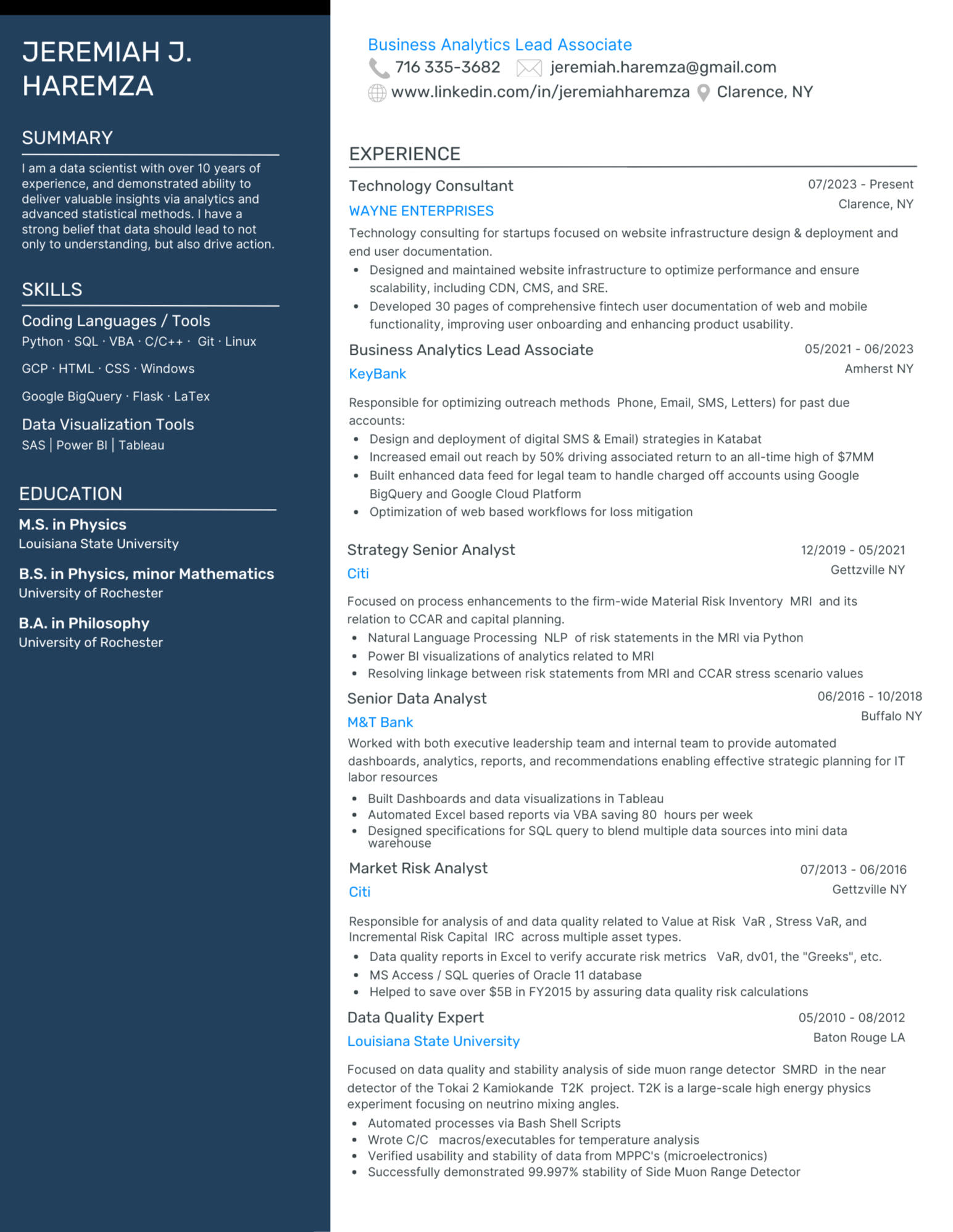

Featured Projects

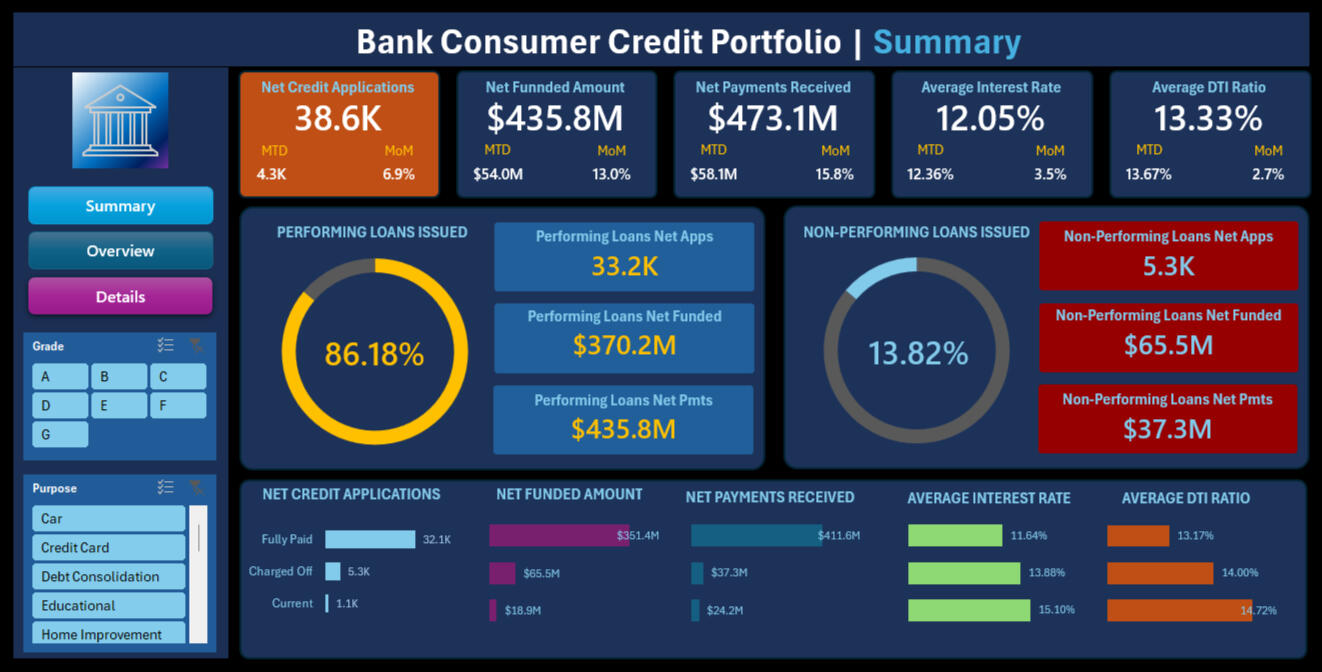

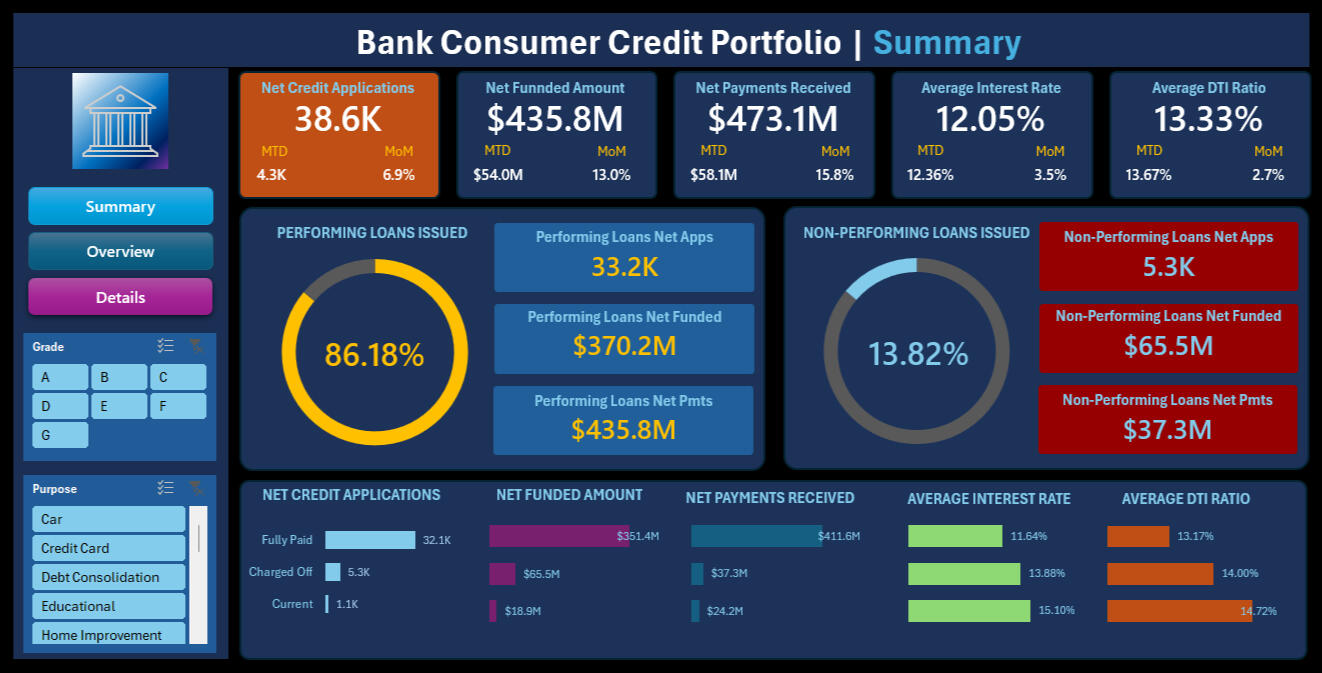

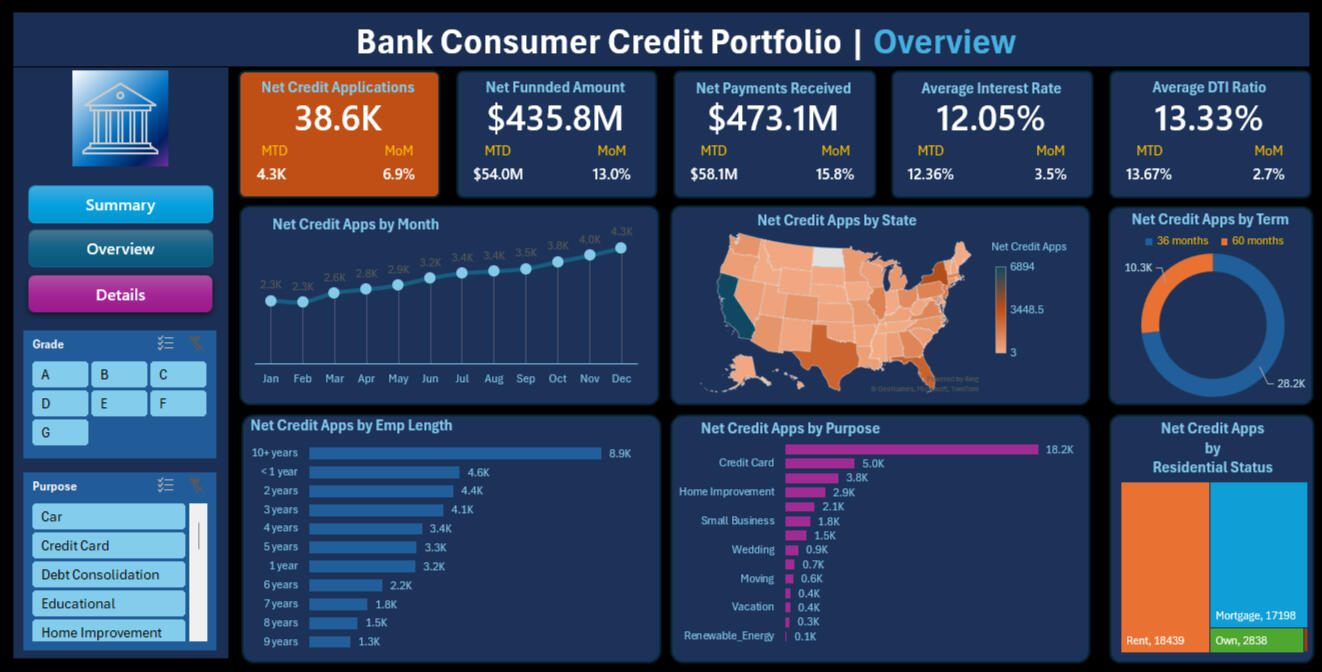

Bank Consumer Lending Portfolio | Excel

As part of its monthly and year-to-date process, the bank looks at high-level KPIs and metrics to review the performance of its consumer lending portfolio.

Goals, Questions, and Stakeholder Requests

Month-over-month (MoM) and month-to-date (MTD) KPIs requested by stakeholders:

Total Credit Applications

Total Amount Funded

Total Payment Received

Average Interest Rate

Average Debt-to-Income (DTI) Ratio

Questions to Answer:

How are different grades and types of loans performing?

What fraction of credit issued is performing vs. non-performing?

Steps to Create the Analysis

Reviewed requirements, determined appropriate data sources, designed initial draft, and outlined process.

Cleaned and formatted data using Power Query.

Created pivot tables to summarize data over time.

Added additional metrics:

Monthly Trend of Net Applications

Geomapp of Applicants by US State

Loan Term Distribution

Applicant Employment Length

Loan Purpose / Credit Type Distribution

Distribution of Residence Type

Built two dashboard layouts summarizing analysis.

Added navigation buttons to both dashboards.

Added slicers for more granular views of dashboard data.

Key Takeaways from the Analysis

As loan grade decreases, the portion of non-performing loans increases.

Debt consolidation loans are the most issued, accounting for the most significant portion of net payments received at $219M (53%).

Of the 13.8% of loans classified as non-performing, 57% of the funds loaned are recovered.

Loans by geography are aligned to population density, indicating the universality of advertising.

Note: All bank information is fictitious, and no PII has been exposed.